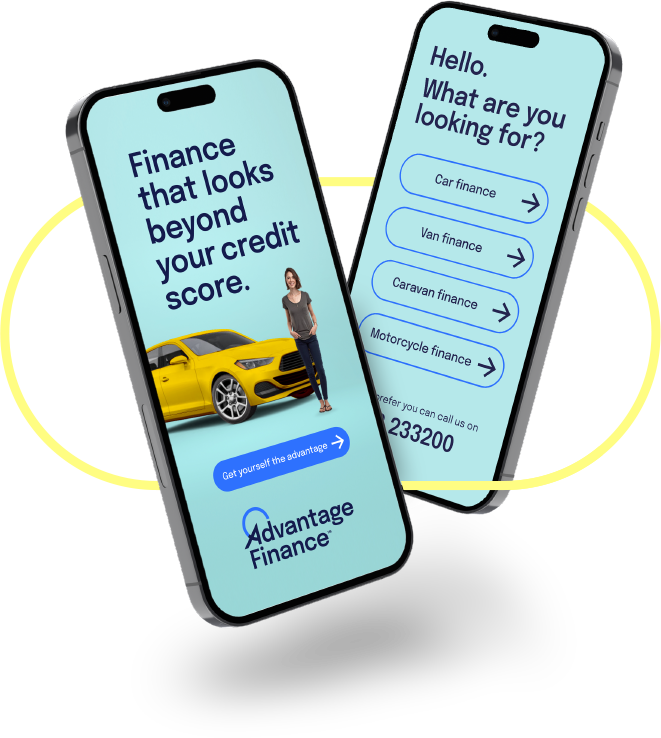

Finance built for humans by humans.

Our friendly humans have been putting conversation before credit scores since 1999, helping thousands of people get moving by listening to their stories and understanding their lives. So, when it comes to arranging finance, we see more than your score.

Talk to us now and let us help you get the advantage.

Get in touch

There's more to a story than a number.

We know how frustrating it can be when you struggle to obtain credit - for us it’s not about bad credit, it’s about looking after our customer, and that’s why here at Advantage we look beyond your credit score.

If you've asked yourself these questions, we’re here to help you.

- Can I get motor finance if I have bad credit?

- Does applying for a loan affect your credit score?

- I've been refused motor finance elsewhere, can I still apply here?

- How can I learn more about my credit score?